SRH Law is delighted to announce that client Champlain Housing Trust (CHT) has closed on an $8.8 million New Markets Tax Credit financing transaction for the rehabilitation of the former St. Joseph’s School on Allen Street in Burlington. SRH Law attorneys Drew Kervick and Victoria Westgate represented CHT in the financing, which will pay for numerous upgrades and renovations to the Old North End Community Center and help anchor important community programs and services in Burlington’s Old North End neighborhood. The rehabilitation work is already underway and includes accessibility upgrades, installation of a new elevator and a commercial kitchen, increased insulation, window replacements, installation of a new highly efficient heating and cooling system, sprinkler system replacement, electrical system updates, and new restrooms, among other things. The community center is home to the City of Burlington Parks, Recreation & Waterfront Department, the Robins’ Nest Children’s Center, the Association of Africans Living in Vermont, and the Family Room, as well as the Very Merry Theatre.

SRH Law is delighted to announce that client Champlain Housing Trust (CHT) has closed on an $8.8 million New Markets Tax Credit financing transaction for the rehabilitation of the former St. Joseph’s School on Allen Street in Burlington. SRH Law attorneys Drew Kervick and Victoria Westgate represented CHT in the financing, which will pay for numerous upgrades and renovations to the Old North End Community Center and help anchor important community programs and services in Burlington’s Old North End neighborhood. The rehabilitation work is already underway and includes accessibility upgrades, installation of a new elevator and a commercial kitchen, increased insulation, window replacements, installation of a new highly efficient heating and cooling system, sprinkler system replacement, electrical system updates, and new restrooms, among other things. The community center is home to the City of Burlington Parks, Recreation & Waterfront Department, the Robins’ Nest Children’s Center, the Association of Africans Living in Vermont, and the Family Room, as well as the Very Merry Theatre.

The complex financing package for the building’s renovations was built around a tax credit allocation from Vermont Rural Ventures that funded nearly one third of the overall project costs. The project received a tax credit equity investment from TD Bank’s Community Capital Group, as well as loans from TD Bank, the Vermont Community Loan Fund, Commons Energy and the Vermont Community Foundation. CHT also received grants from the Vermont Community Development Program, the City of Burlington, and NeighborWorks, energy efficiency incentives from Vermont Gas and Burlington Electric, and critical charitable contributions and support from the community. These investments will enable the Old North End Community Center to continue to serve the needs of Burlington’s Old North End Community for many years to come.

The New Markets Tax Credit (NMTC) program is a federal program that incentivizes investment in low-income communities by providing private investors with federal tax credits for qualifying investments in businesses or economic development projects in economically distressed areas. SRH Law attorneys have years of experience with NMTC financings, having represented both project developers and lenders in such transactions. We recently blogged about the New Markets Tax Credit financing for another SRH Law client, Chroma Technologies. You can read more about that project here. To learn more about financing projects using federal tax credit programs and incentives such as New Markets Tax Credits or the Opportunity Zone tax incentive, contact Drew Kervick.

The decommissioned Blodgett Oven factory on Lakeside Avenue in Burlington, Vermont is being redeveloped into a dynamic new tech campus, providing work spaces to new and existing employers in the field of technology. Developer Russ Scully is converting the old factory into a high-tech campus, called

The decommissioned Blodgett Oven factory on Lakeside Avenue in Burlington, Vermont is being redeveloped into a dynamic new tech campus, providing work spaces to new and existing employers in the field of technology. Developer Russ Scully is converting the old factory into a high-tech campus, called

Partner

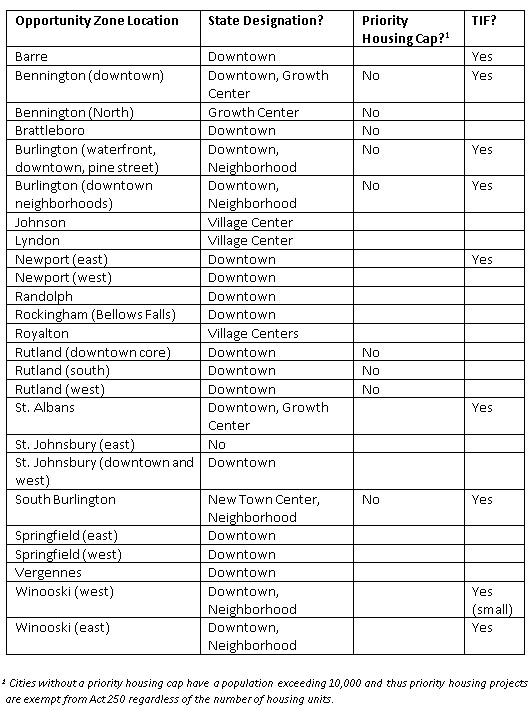

Partner  and the benefits it could provide for Vermont communities, investors, and developers. While we await the IRS regulations governing the mechanics of opportunity zone investing, we thought it would be a good time to examine how state planning law might affect potential opportunity fund financed projects.

and the benefits it could provide for Vermont communities, investors, and developers. While we await the IRS regulations governing the mechanics of opportunity zone investing, we thought it would be a good time to examine how state planning law might affect potential opportunity fund financed projects.

Last year’s federal Tax Cuts and Jobs Act (the “Act”) contained many substantial changes to the tax code to generate a $1.5 trillion tax cut. Included in the Act was a “small” $1.5 billion provision that could have an outsized effect in small, rural states like Vermont.

Last year’s federal Tax Cuts and Jobs Act (the “Act”) contained many substantial changes to the tax code to generate a $1.5 trillion tax cut. Included in the Act was a “small” $1.5 billion provision that could have an outsized effect in small, rural states like Vermont.  SRH Law was a proud sponsor of the recent 2018 Bi-State Primary Care Association Conference held in Fairlee, VT. The Bi-State Primary Care Association is a nonpartisan, nonprofit organization that represents New Hampshire and Vermont’s 28 Community Health Centers serving 300,000 patients at 120 locations.

SRH Law was a proud sponsor of the recent 2018 Bi-State Primary Care Association Conference held in Fairlee, VT. The Bi-State Primary Care Association is a nonpartisan, nonprofit organization that represents New Hampshire and Vermont’s 28 Community Health Centers serving 300,000 patients at 120 locations.

On Thursday, Governor Scott announced that the Vermont Housing Finance Agency (VHFA) successfully placed $37 million in sustainability bonds to fund the State’s “Housing for All” affordable housing initiative. The bond sale was very well received by investors, reportedly receiving seven times more orders than available bonds.

On Thursday, Governor Scott announced that the Vermont Housing Finance Agency (VHFA) successfully placed $37 million in sustainability bonds to fund the State’s “Housing for All” affordable housing initiative. The bond sale was very well received by investors, reportedly receiving seven times more orders than available bonds.